DS Swap

Understanding Decentralized Exchanges (DEXs)

Decentralized Exchanges, or DEXs, represent a paradigm shift in how assets are traded, moving away from traditional centralized exchanges to platforms where trades occur directly between users through an automated process. Here's a breakdown of what DEXs entail:

Non-Custodial. Unlike centralized exchanges where users must deposit their funds into the exchange's wallet, DEXs allow users to retain control of their private keys and, by extension, their assets. This reduces the risk associated with exchange hacks.

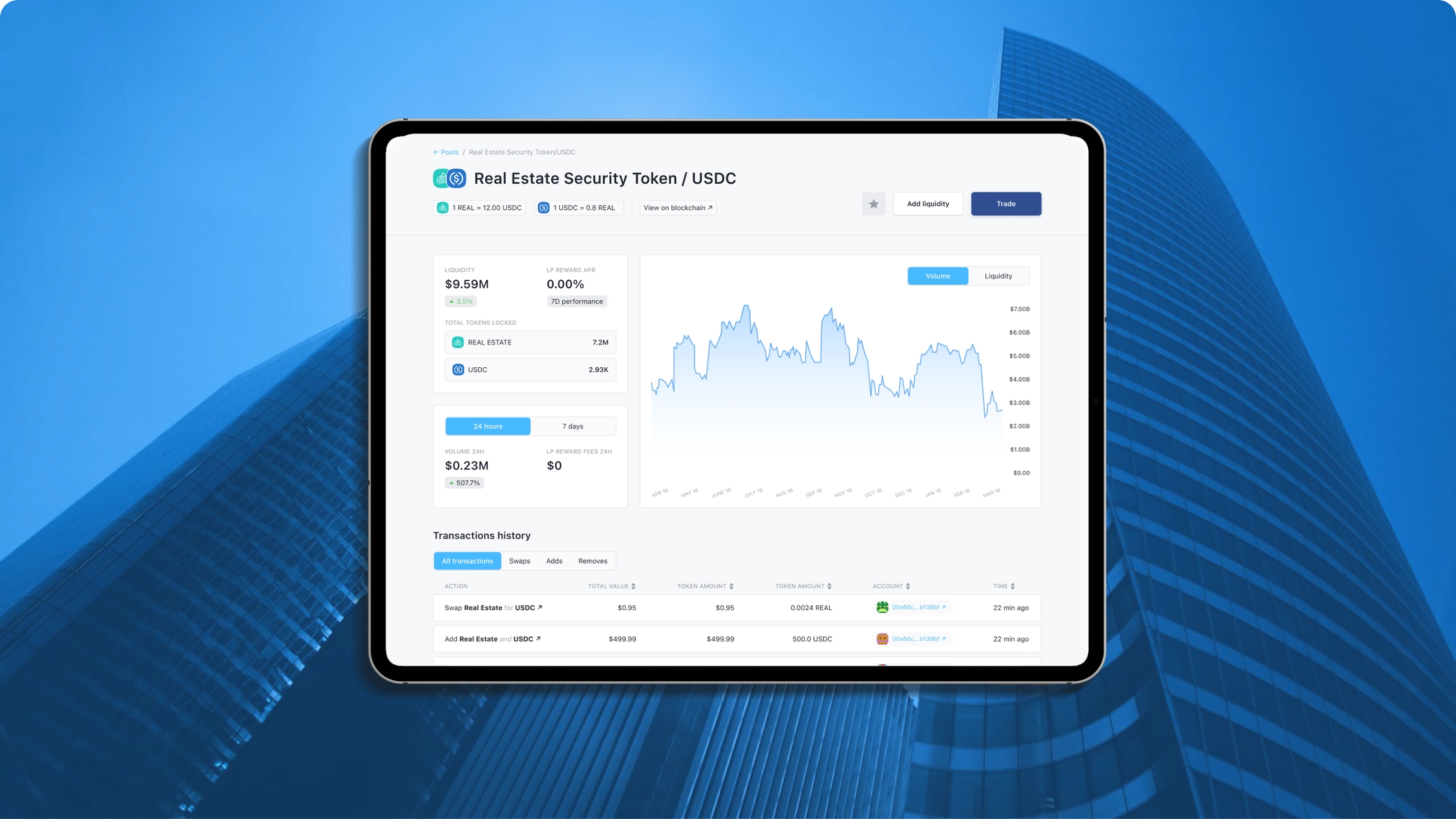

Liquidity Pools. Instead of traditional order books, many DEXs use liquidity pools where users can lock their assets into smart contracts to provide liquidity for trading pairs. In return, liquidity providers earn fees from the trades that occur in their pool.

Automated Market Makers (AMM). Most DEXs operate on an AMM model, where the price of assets in a liquidity pool is determined by a mathematical formula. This formula adjusts the price based on the ratio of assets in the pool, ensuring that there's always liquidity for trading, albeit with the potential for slippage.

Decentralized Exchange, or DEX for Security Tokens

DS Swap is an innovative decentralized finance (DeFi) solution tailored for the secondary trading of security tokens and crypto assets, operating exclusively on the Binance Smart Chain (BSC). This platform allows security token issuers to manage liquidity pools and automate market-making processes within the DeFi framework. Here are some key points to consider about DS Swap:

Compliance and Trading. DS Swap ensures that all trading activities involving security tokens comply with international regulations. Only verified users, who have passed KYC (Know Your Customer) checks, can engage in trading, which helps in maintaining a secure and compliant trading environment.

Network Limitation. Operating solely on BSC, DS Swap leverages the blockchain's capabilities for faster transactions and lower costs compared to other networks like Ethereum. However, this exclusive operation on BSC also means that DS Swap's liquidity and trading opportunities are inherently limited to what BSC can support. This can affect the breadth of assets available for trading and might restrict access to liquidity pools that could be more diverse or liquid on other networks or through cross-chain functionalities.

Zero-Fee for Security Token Swaps. One of the standout features is the zero trading fee for security token transactions, which encourages trading without the burden of additional costs. For other crypto assets, a minimal fee structure is in place, which contributes to liquidity pools and platform operations.

Integration with Stobox DS Dashboard. DS Swap integrates seamlessly with the Stobox DS Dashboard, providing issuers with tools to enable and customize swap functionalities for their tokens, ensuring that only authorized participants can contribute to liquidity for security tokens.

Corporate Governance. Through unique smart contracts, DS Swap enforces the issuer's corporate rules for secondary trading, ensuring that all trades reflect the governance standards set by the token issuers themselves.

DS Swap represents a specialized tool within the DeFi space, focusing on security tokens with an infrastructure built on BSC's capabilities. While this specialization offers tailored solutions for security token trading, it also encapsulates the platform within the limitations of BSC's ecosystem, affecting potential liquidity and the scope of trading opportunities available to users.

Was this helpful?